The upcoming US Federal Open Market Committee (FOMC) meeting, scheduled for March 18-19, has become a focal point for investors worldwide. With expectations high, the Fed meeting is seen as a crucial indicator of the stock market’s direction and gold prices. Following the recent surge in gold to a record high of $3,004.86 per ounce, market participants are closely watching how the Fed’s decisions might shape the economic outlook.

Impact of the Fed Meeting on Gold Prices

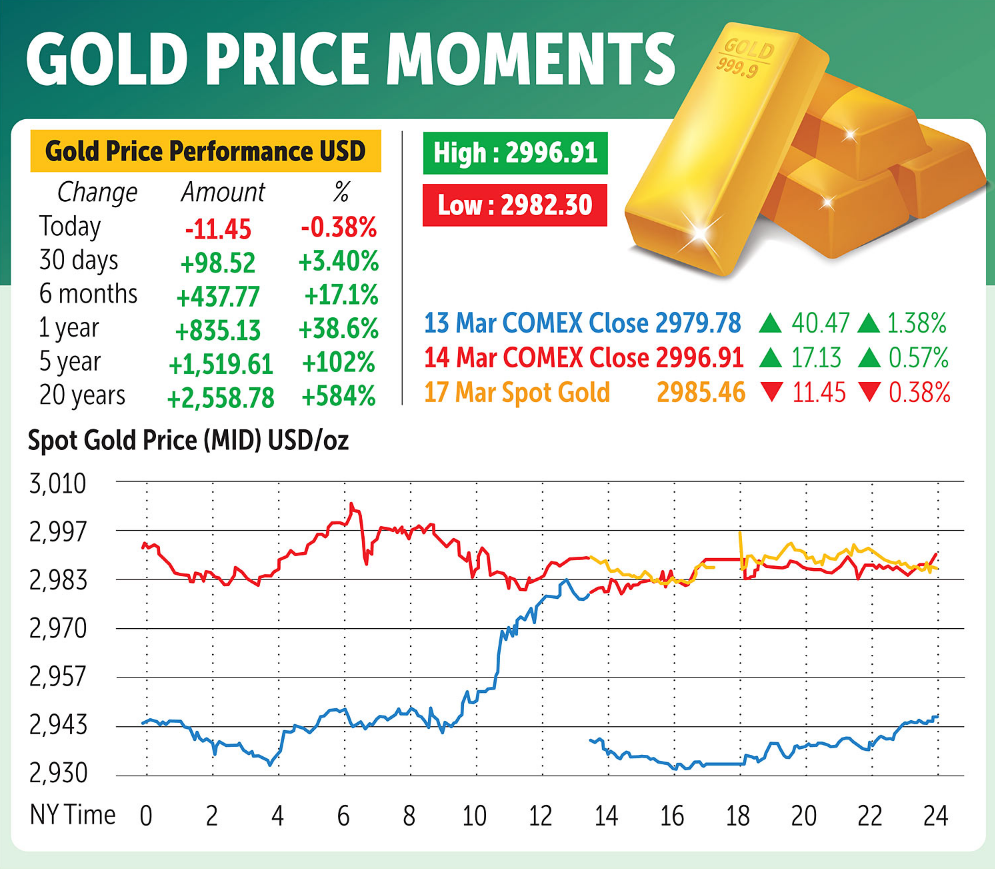

Gold prices have been experiencing volatility in the wake of the rising uncertainty around global trade and the US economy. Following the peak of $3,004.86 per ounce, a slight profit-taking resulted in a slight decline, bringing gold down to $2,986.26 per ounce. Despite this, gold remains supported by strong demand from central banks and investors seeking safe assets amid trade war risks and potential economic slowdown.

As the Fed meeting approaches, analysts predict that the central bank will likely keep interest rates unchanged. Investors are keen on the Fed chairman’s statement, which may offer clues regarding future rate cuts. If the Fed signals a dovish stance, it could provide further support to gold and global markets.

Economic Context Surrounding the Fed Meeting

The upcoming Fed meeting takes place against the backdrop of concerns over a potential economic slowdown. Recent inflation data for February, including the Consumer Price Index (CPI) and Producer Price Index (PPI), came in lower than expected. This has fueled speculation that the Fed might cut rates further, which could bolster gold prices and spark more interest in riskier assets, including equities.

Additionally, the ongoing trade tensions, particularly with China, and the possibility of tariffs have prompted many investors to turn to gold as a safe haven. With central banks like China increasing their gold reserves, the precious metal remains a top choice for diversifying risk.

Gold Market Trends and Predictions

Gold prices surged to a record high last week, driven by market uncertainty and the possibility of rate cuts by the Fed. While a slight pullback was observed, analysts believe that gold’s long-term upward trajectory remains intact. Domestic gold prices in Thailand, for example, reached a record high of 47,650 baht per one-baht weight, indicating strong global demand.

Hua Seng Heng analysts suggest that while gold may experience short-term declines, the long-term outlook remains bullish, particularly if the Fed adopts a dovish approach in the coming meeting. Investors are advised to “let profits run,” holding onto gold for potential gains.

Broader Economic Impact of the Fed Meeting

Beyond the gold market, the Fed meeting will have far-reaching effects on broader financial markets. If the Fed indicates further rate cuts, it could boost global stock markets, the value of gold, and other risk assets. Conversely, if the Fed adopts a more hawkish stance, it could put pressure on equities and commodities.

Investors are also looking at US retail sales data and other economic indicators this week to gauge the health of the US economy. The Fed’s decision will heavily influence the future trajectory of the US dollar and the Thai baht, which has seen fluctuations due to the strengthening US dollar.

Conclusion: The Fed Meeting’s Critical Role in Shaping Markets

As we approach the March Fed meeting, all eyes are on the potential impact it will have on gold prices, equities, and the broader economy. Market participants are closely watching the Fed’s stance on interest rates and the accompanying statement for clues about future economic policy. A dovish Fed could signal more opportunities for gold and risk assets, while a hawkish stance may lead to increased volatility in financial markets.

See more articles

Betting: คู่มือพื้นฐานและรายละเอียด

เว็บ สล็อต ออนไลน์: ทางเลือกใหม่ในการเล่นเกมคาสิโนออนไลน์

Football Prices: ทำความเข้าใจเกี่ยวกับค่าใช้จ่ายและปัจจัยที่มีผลต่อมูลค่าฟุตบอล